Part 2: Key manufacturers, plant engineering and technologies

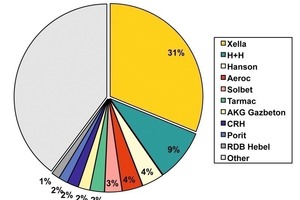

The economic crisis has not bypassed the European autoclaved aerated concrete industry. The first plants have been decommissioned or temporarily shut down. Pressure on the price of aerated concrete has grown. It is in the interest of manufacturers to focus on commercially viable utilization rates. The market is fragmented: the two leading companies account for 40% of market share while the top 10 account for only 61 % in total. However, it is clear that there will be significant changes over the coming years, in particular as a result of new plants that are now constructed in Eastern Europe which will profit from the latest technology and will, in part, replace old plants. Part 2 of this market overview takes a closer look at the key manufacturers and the most important technologies for producing autoclaved aerated concrete.

The first part of the market overview (BFT INTERNATIONAL 12/2009) focused on current and future market developments, sales figures and selected countries.

The largest manufacturers

The autoclaved aerated concrete industry in Europe is relatively fragmented. Within that market, including Turkey, there are 189 production plants with a total capacity of 42 million m3 and a production output in 2008 of 29.7 million m3, which corresponds to an average utilization of 70.6% [1]. While the EAACA member states of EU27 had the lowest utilization rates in 2008, the utilization rates in the eastern...