Precast elements in Austria in demand more than ever

In the first half of this year, the precast sector in Austria was once again able to markedly increase its turnover from the outstanding year before. The strongest growth sectors are, as in the previous year, residential and office building construction as well as commercial real estate. The consistently positive economic conditions, growing demand and high capacity utilization in the companies, moreover, are boosting contractors’ willingness to invest and ensure a rising employment rate.

The construction boom, however, also brings additional challenges. Many companies are now reaching their limits, and resources are becoming scarce. Better planning in order management by clients could shorten delivery times and again significantly improve delivery reliability.

Construction boom and its downsides

What last year could be called a construction boom, could now be even topped. According to the results of the current VÖB economic barometer, two thirds of the concrete and precast plants are expecting in 2018 a new rise in turnover by an average of 5 % over the previous year. If growth in the past years was consistently regarded as positive, the downsides of the construction boom are now also becoming apparent.

Franz Josef Eder, President of VÖB, explains the situation: “Although 2018 once again resulted in a plus in order books in the concrete and precast sector, this is by now leading to hamster-like behavior of individual customers and contractors. Examples of this are more than enough in other trades, such as formwork companies and scaffolding leasing companies.”

Gains through residential, office and industrial building

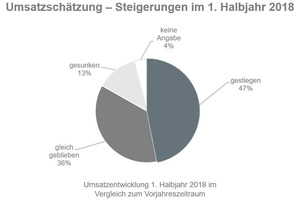

In general, the sector can’t complain: Owing to the strong construction economy, 83 % of the companies were able to record at least the same or even higher turnovers than in the first six months of 2018. Reasons for full capacity utilization in the companies include the good economic situation as well as rising demand.

A total of 78 % estimate that the peak of the demand for precast elements has not yet been reached. In addition, the still high willingness to invest – in particular by the real estate sector – leads to peak utilization, which is making itself felt in the companies.

Shortage of precast technicians

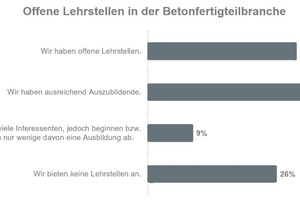

A positive effect of this development is that three out of four companies are now heavily investing in the future: for one, in form of technological modernization measures and, secondly, in training positions. Although on average every other company provides training, every third company has problems with actually finding apprentices and states lack of interest in these skilled trades. There is a special shortage of precast technicians, despite the high demand in that sector.

Eder warns: “There is a shortage of workers not only at construction sites, but in our sector as well. The challenges the workers are facing – owing alone to full capacity utilization – are enormous. In addition, there is uncoordinated deadline scheduling in orders and frequent changes in the content of construction-related support in building planning. Even experienced workers find this development hard to bear, which therefore leads to difficult working conditions.

Great demand and planning chaos

However: turnover, according to Eder, does not increase to the same extent as full order books. And he notes: “Delivery times in the precast sector are for the most part considerably long. Here, the situation is also characterized by the deadline planning of clients. The consequences: turnovers increase only partially, because capacities beginning already in 2017 were exhausted, and because prices have not yet appreciably increased.”

But the situation could easily be improved: “Construction processes could be significantly facilitated with more carefully conducted planning: This would also result in more normal and more attractive work,” as appeals Eder to the delivery and value-added chain in the entire construction industry. This is the only way to make the boom phase a success for all concerned.