Market trends for green cements for environmentally friendly concretes (Part 2)

Green cements are booming because the cement and concrete industry is on a net-zero journey to become carbon-neutral by 2050. What are the latest market trends for green cements and which types of green cement will have a major impact? Some answers will be given in Part 2 of this article (Part 1 see BFT 12/2023).

Figure 10 indicates the energy- and material-related carbon emissions of the various ACTs reviewed [6]. As the production processes of X-clinker and Celitement can be fully electrified, the thermal component of the carbon emissions of these processes can be completely eliminated, depending on the type of electricity used, which will give them a huge benefit in comparison to the other processes when low-carbon cements are required. Nevertheless, the binder characteristics and availability of the raw materials required for the processes also play a major role. The authors [6] have come to the conclusion that a high availability is ensured for all processes except for CSA and BYF clinkers. CSA cements have been largely used in China since 1970, with an estimated annual production of 2-3 Mt/a [7]. Calcium sulphoaluminate cements require both a higher Fe2O3 and higher Al2O3 content in the raw material, which could be partially satisfied by using bauxite residue.

In the Western world, a number of cement producers manufacture CSA cements for special applications, including Buzzi Unicem, Ciments Vicat and Holcim. Heidelberg Materials and Holcim have developed belite-based CSA cements (BCSA) under the brand names of Ternocem and Aether. CSA cements are not classified as cements according to EN 197-1. In most cases, these binders therefore still require a technical approval for use in structural concrete. In China, belite-based low-carbon clinker cements are also gaining in importance [8]. In the last few years, belite-rich Portland cement (RBPC) has been manufactured on an industrial scale. According to standard GB200-2003, RBPCs are classified as low-heat Portland cements. These cements are used as a type of low-energy, low-emission, high-performance cements with an acceptable three-day to seven-day early strength, 28-day strength equivalent to Portland cement and improved durability.

In autumn 2021, Schwenk Zement upgraded the capacity of an existing pilot plant for the production of Celitement (Figure 11) to 1 t/d. The pilot plant is used for process and product development and provides material samples of different types of Celitement for customer application testing [9]. The new cement binder is tested in various real-life applications to provide feedback for the market demand and the intended investment in an industrial plant. The first reference plant will have a capacity of about 50,000 t/a. Installation has been scheduled for 2025. Around 600 kg of high-quality Ca(OH)2 and 400 kg of quartz sand are needed to produce 1 t of Celitement. The raw materials will be autoclaved in a process similar to the production of autoclaved aerated concrete (AAC). White binder (L>90%) can be produced if pure raw materials low in Fe2O3 content are used. Once the tests have been successfully completed, the technology will also be licensed to interested parties.

4 Production of calcined clay

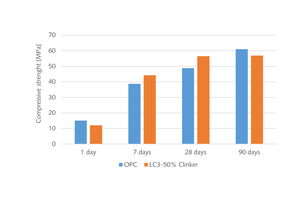

The production of calcined clays for use in the cement and concrete industries has become a success story in recent years [10, 11]. An LC3 project started in 2013 at EPFL in Lausanne, Switzerland, shows that the synergetic reaction of calcined clay and limestone allows high levels of clinker substitution. LC3 is synonymous for limestone calcined-clay cements. The LC3 family of cements requires 50% less clinker than OPC, produces 40% less CO2, and has a similar strength development (Figure 12), better chloride resistance and resistance to alkali silica reaction. It has been shown that the main clay-size minerals such as kaolinite, illite, smectite, vermiculite and montmorillonite are available in all world regions. Clay can be easily activated but the optimum activation temperature regime for each clay deposit has to be analyzed. Rotary kilns or flash calcination technologies can be used for clay activation (calcination).

Flash calcination systems not only offer advantages in terms of installation, operating and maintenance costs when compared to rotary kiln systems, but also higher clay reactivity, resulting in a larger degree of clinker substitution (35-40% for flash calcination and 20-25% for rotary kiln calcination). This trend can also be seen in the latest plant projects. New plants have become operational in the USA, Denmark, France, Colombia and Angola. Additional calcined-clay plants will be installed in France, Portugal and Ghana in this year and the next. The projects show a trend to increasing plant capacities. While in previous years, plant capacities have mostly been below 0.1 Mt/a, plants with a capacity of 0.4 Mt/a and even higher are now being built. In India, the first projects are now also in the planning stage.

The pioneers in recent years have been Argos in Colombia, Hoffmann Green Cement in France and Cimpor in Portugal. Cementos Argos invested US$ 78 million to build its first calcined-clay facility at the Rio Claro plant (Figure 13) in Colombia. Construction started in March 2017, and the facility became operational in 2020, being the largest plant at that time with a production capacity of 1,500 t/h or 0.45 Mt/a of calcined clay. The raw clay is mined in the Altorrico mine, close to the Rio Claro plant. The average kaolinite content is 25-38%. Cementos Argos plans to produce 3.0 Mt/a of calcined clay by 2030. Future cement capacity additions will prioritize calcined-clay projects. New projects in other regions are on the horizon to pave the way for the company’s short-term, medium-term and long-term goals.

Hoffmann Green Cement is considered the pioneer in Europe for the design, production and distribution of low-carbon cements with a carbon footprint 6 times lower than that of conventional Portland cement. The company was founded in 2014 and opened the first production plant for low-carbon cements in Bournezeau in Western France. A second plant (Figure 14) with a capacity of 0.25 Mt/a has been commissioned at the same site. A third plant will be installed in Dunkerque in 2024 to have a combined capacity of 0.5 Mt/a. In addition to H-EVA cement, which is based on calcined clay and gypsum, Hoffmann Green Cement produces three other patented low-carbon cements. H-P2A is a geopolymer adhesive, which is based on a two-component system containing activated clay and silicate. Hoffmann Green Cement is licensing its technologies. In June 2023, it was announced that Hoffmann Green Cement signed an exclusive agreement with Shurfah Holding to build four Hoffmann facilities in Saudi Arabia.

Cimpor Global Holdings, which is part of the OYAK Group, installed its first calcined-clay plant in Abidjan in Côte d’Ivoire. The plant has been operational since August 2020 and is considered the first greenfield integrated cement plant based on calcined clay (Figure 15). The rotary kiln used for the production of calcined clay has a capacity of 0.3 Mt/a, and the plant’s cement production capacity is 2,400 t/d. Cimpor has placed an order for a second clay calcination plant for their Kribi location in Cameroon. This plant will use the flash calcination technology. It will have a capacity of 720 t/d of calcined clay and 2,400 t/d of cement. Commissioning of the plant was scheduled for 2023. In the last few years, Africa has become a hotspot of clay calcination. Another large plant will be installed in Ghana. This project will be implemented by CBI Ghana in Accra, involving installation of the world’s largest gas-suspension calcining system and a grinding capacity for calcined clay of 0.72 Mt/a. Heidelberg Materials have acquired a 50% stake in CBI to reduce the need for clinker imports in the region.

5 Outlook

New cements on the basis of a new clinker composition will have their market. To give an example: in China, about 2-3 Mt/a of CSA cements are produced each year. At the moment, this corresponds to a market share of only 0.1% to 0.15%. If the production of CSA cements continues at the same level, the market share could increase to between 0.12% and 0.18% by 2030 because China’s cement production is expected to decrease. This would imply that new cements will mostly cover only niche markets. However, a huge impact can be expected from the production of calcined clays. This thermal activation process could achieve very high market shares.

It is too early to comment on whether a production level of 350 to 400 Mt/a will be possible by 2050, as projected by the IEA. There are some experts in the market who also see a potential in mechanical clay activation. OneStone Consulting plans to provide a multi-client report on the market for activated clays in autumn 2023.

REFERENCES/LITERATURE

![Fig. 10: CO2 contribution of ACT processes [5]](https://www.bft-international.com/imgs/2/0/4/0/2/7/4/tok_f3c0e6fe316c8366051b548904c21994/w300_h200_x600_y307_HA_1221_Fig.10_Fig10L_ACT2-2dcd2fa3bdc82ddf.jpeg)