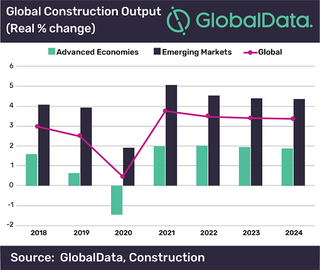

GlobalData sharply revises down forecast for constructionoutput growth globally to just 0.5% in 2020

07.04.2020

Figure: GlobalData

Figure: GlobalData

Prior to the coronavirus (COVID-19) outbreak, leading data and analytics company GlobalData had predicted that there would be an acceleration in the pace of growth in the global construction industry, but given the severe disruption in China and other leading economies worldwide following the outbreak, the forecast for growth in 2020 has now been revised down to 0.5% (from 3.1% previously).

The current forecast assumes that the outbreak is contained across all major markets by the end of the second quarter, following which, conditions would allow for a return to normalcy in terms of economic activity and freedom of movement in the second half of the year. However, there will be a lingering and potentially heavy impact on private investment owing to the financial toll that was inflicted upon businesses and investors across a wide range of sectors.

While growth in 2021 will be marginally higher than previously expected owing to the projected rebound (and high year-on-year growth rate) in the first half of next year, in the event that the spread of the virus continues into the second half of 2020, further downward revisions to the growth outlook are likely.

Danny Richards, Lead Economist at GlobalData, comments: “With extreme quarantine measures including lockdowns of entire countries as well as international travel restrictions being imposed across many major economies, the supply shock is expected to dampen economic activity. The direct impact on construction has been the halting of work with labor unable to get to sites or because of disruption in the delivery of key materials and equipment.”

More generally, the construction industry will be heavily affected by the expected widespread disruption to economic activity and a likely drop in investment, with planned projects being delayed or canceled. GlobalData foresees particular struggles in the commercial and industrial sectors; businesses in these sectors are most at risk from the severe drop in economic activity, domestically and globally, and their immediate priorities will be on staying afloat and rebuilding their core operations, rather than expanding and investing in new premises or capacity. The residential sector also will struggle as economic activity weakens and unemployment rises, despite low interest rates and direct government support. There is a high risk that a considerable proportion of the early stage projects in these sectors will be canceled or at least pushed back, with few new projects starting in the second quarter of 2020 as firms review their expansion plans.

Richards adds: “Governments and public authorities will likely be aiming to advance spending on infrastructure projects as soon as normality returns so as to reinvigorate the industry. With interest rates falling to record lows, borrowing costs will be at a minimum, but the success of government efforts to spend heavily on infrastructure will be dependent in part on their current financial standing. Moreover, with most governments prioritizing cash hand-outs, particularly to the economically weaker segment, their capability to invest in the infrastructure segment is likely to be constrained, especially in countries with high debts.”

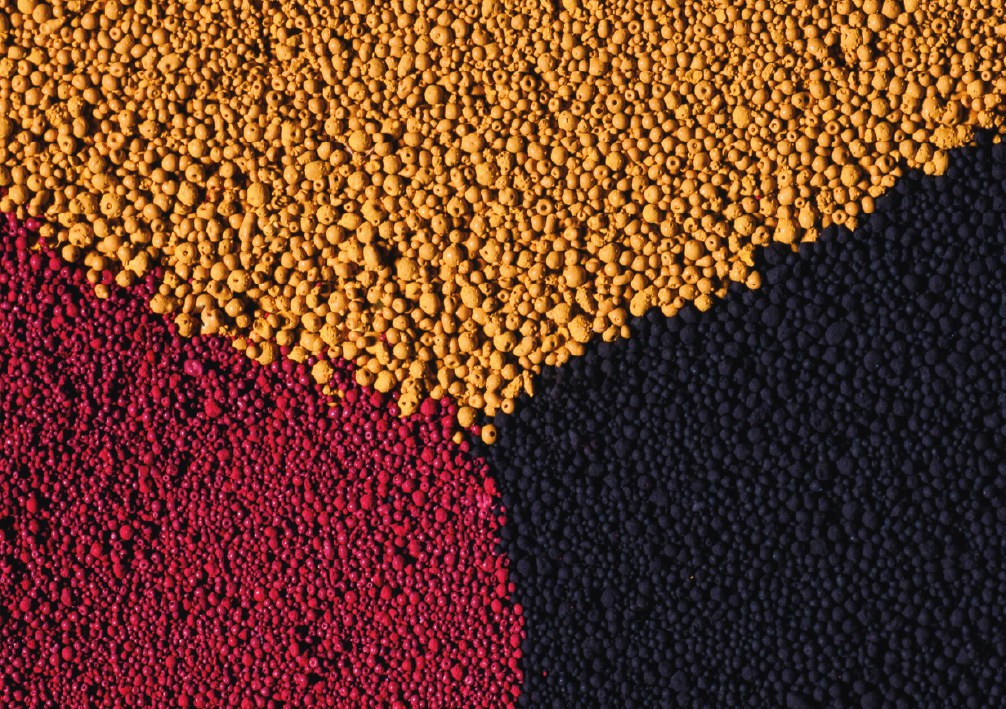

C&G Pigment, ein führender Vermarkter anorganischer Pigmente, hat ein Tochterunternehmen mit Sitz in Leverkusen, Deutschland, gegründet. Damit errichtet die Firma ihre europäische Präsenz zur Vermarktung des Produktportfolios namhafter chinesischer Hersteller für den gesamten Kontinent.

C&G Pigment mit ihrem Sortiment bestehend aus Eisenoxid-, Titandioxid- und Rußpigmenten hat die Eröffnung einer deutschen Tochterfirma unter dem Namen C&G Pigment Europe GmbH bekannt gegeben. Dieses Unternehmen dient als Plattform, um das Produktportfolio einschließlich der marktgerechten Logistikleistungen in Europa anzubieten. Die Firma hat ihren Sitz in Leverkusen, Deutschland, und wird von Geschäftsführer Axel Schneider geleitet.

„Auch wenn das Wettbewerbsumfeld in Europa sehr intensiv ist, so sind wir doch von dem Potenzial überzeugt, welches der Markt für uns bereithält“ sagt Jiming Cai, Gründer und Eigentümer von C&G Pigment. „Unsere Partner sind sehr daran interessiert daran, ihr Geschäft in diesem Markt zu entwickeln und unterstützen uns nach Kräften. Somit freuen wir uns darauf, mit unserem vollen Fokus auf Pigmente den europäischen Kunden Expertise und Mehrwert zu bieten.“

CONTACT

GlobalData

John Carpenter House

7 Carmelite StreetErnst-Bloch-Straße 16

London51377 Leverkusen/United Kingdom

+ 44 207 832 4399